Actuarial Solutions

Discover digital-driven solutions for sustainable success 1

Insurance Modernization

Traditional

- Manual portfolio management

- Traditional models (classic)

- Long time-to-market

- High costs

Modern

- Automated portfolio management and decision- making

- Innovative models

- Accelerated time-to- market

- Low costs

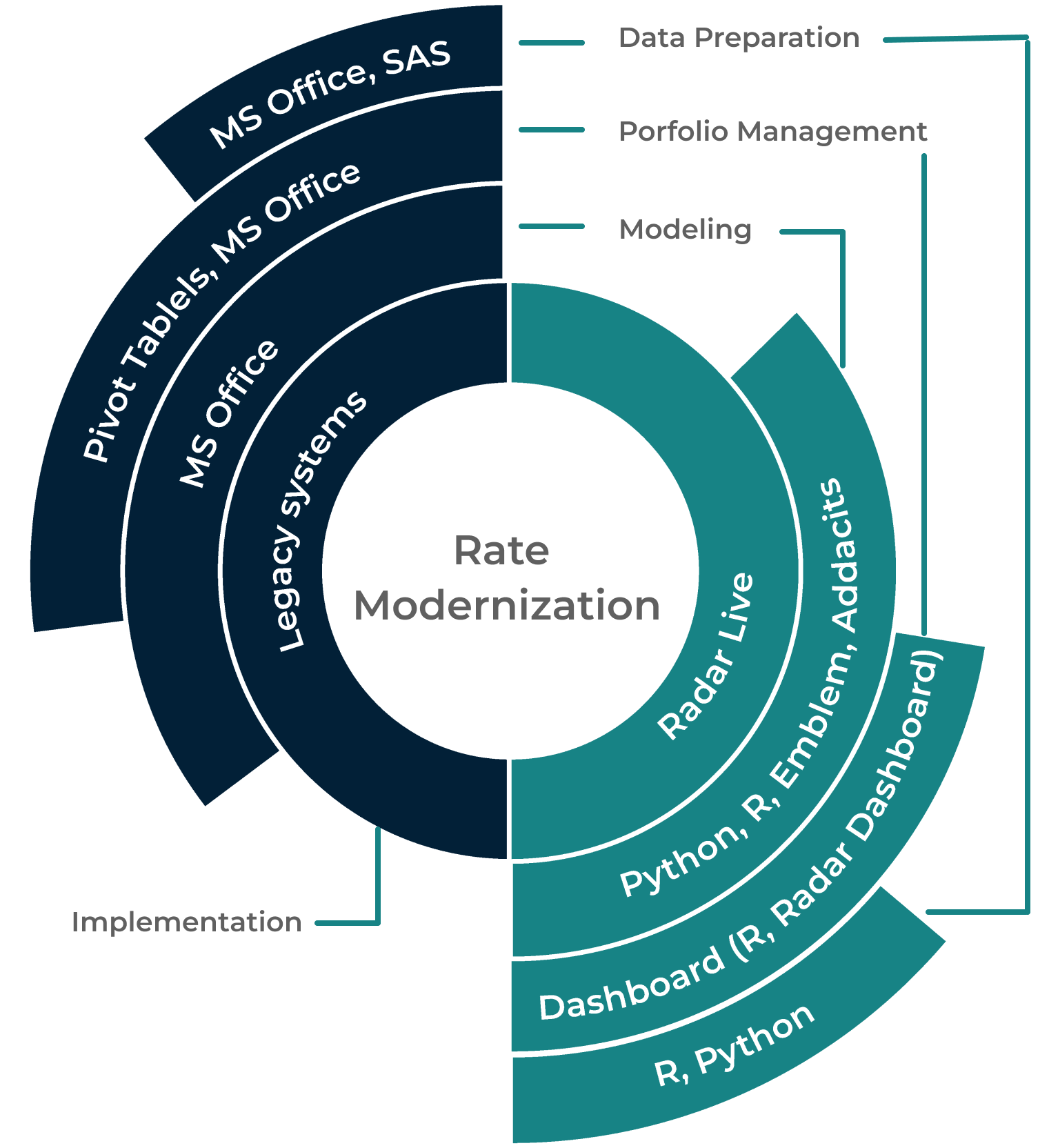

Our Approach to Actuarial Transformation

We align our clients with the ongoing dynamic developments and digital innovations by diversifying and enhancing their offerings and ecosystems. We customize our actuarial strategy to meet the unique requirements and goals of your organization so that actuaries and actuarial functions can undergo transformation. For better output and greater customer experiences, our process typically involves the following steps:

Research and Discovery

We conduct a comprehensive assessment of your current portfolio of products, processes, profitability and metrics to define objectives for the actuarial transformation, aligning them with the organization's overall strategy and identifying limitations. The goals may include improving accuracy, efficiency, risk management, regulatory compliance, or leveraging new technologies.

Active Portfolio Management

Based on the assessment findings, we develop a customized solution design that serves as the transformation roadmap outlining special strategies, technologies, and talent required to achieve your goals and eliminate inefficiencies. We streamline data usage to identify areas where automation or standardization can be applied and implement best practices with agile methodologies to improve speed, accuracy, collaboration and consistency of calculations. This boosts process speed and reduces the time-to-market.

Automation and Process Upgradation

We deploy automation via dashboards and conduct performance management for periodic reviews and adjustments to update actuarial models by resetting the actuarial baseline, facilitating significant acceleration in incremental continuous improvement. We leverage functions like reserving, pricing, modeling, finance integration and risk management to lead innovation.

Advanced Deployment and Value Alignment

We develop a detailed implementation plan with clear milestones, responsibilities, and timelines. At this stage, we engage the stakeholders across the organization and implement the transformation initiatives. Our team works closely with your organization to implement the identified solutions, leveraging our expertise and guiding your team through the transformation process. We provide training, guidance, and end-to-end support to ensure a smooth transition and adoption of the new processes and technologies.

Monitoring and Optimization

We continuously monitor the implemented changes, measure their impact, and provide ongoing support to optimize performance, address challenges, and ensure long-term success.

NLB InsurTech offers end to end rating modernization services leveraging powerful AI tools to ensure better ROI on your every insurance product and offering. We go beyond the mandate of a standard Rating as A Service(RAAS) partner to offer:

Seamless Rating Modernization Services

AI Powered Transformation

Innovation

Product Design

Model development, implementation and maintenance

Experience Studies

Testing

Reduce TAT

Training & advisory

Insurance Operations

Leave all your customer verification, documentation and recordkeeping worries to us. We have a proven track record of managing large scale customer databases for organizations across the globe. Our cutting edge OCR data extraction technology helps us efficiently validate customer information.

Reduced Model Update TAT

Omni Channel Support

Technology Support

MLOps and Automation

Talent Solutions

Why Enact for Your Insurance Operations?

Reduced TAT

24x7 Support

Reduced Costs with Right Shoring

.webp)