Our Services

Rating-As-A-Service

Experience the future of insurance pricing and rating modernization with our comprehensive solutions. Accelerate your go-to-market strategy and launch innovative insurance products with unprecedented speed, efficiency, and auditability.

Roadmap & Platform Selection

Roadmap & Platform Selection Data Collection & Migration

Data Collection & Migration Rating Engine Development

Rating Engine Development API Development for Integration with policy administration and other systems

API Development for Integration with policy administration and other systems

Testing & Quality Assurance

Testing & Quality Assurance Deployment & Rollout

Deployment & Rollout Ongoing Maintenance & Updates

Ongoing Maintenance & Updates

Advanced Analytics & MLOps

NLB’s Analytics & MLOps expertise enables our clients to productionize models visualized by the data scientists. We also help our clients perform Proof-Of-Concept (PoC) with emerging technologies.

Emerging Technologies

Knowledge Graph

Knowledge Graph Generative AI

Generative AI Blockchain

Blockchain

Natural Language Processing (NLP)

Natural Language Processing (NLP) Internet Of Things (IoT)

Internet Of Things (IoT)

MLOps

Model Assessment – Review & Validation

Model Assessment – Review & Validation Refactoring – Model optimization for existing stack

Refactoring – Model optimization for existing stack

Feature Engineering

Feature Engineering Integration with data sources

Integration with data sources CI/CD pipelines and Testing

CI/CD pipelines and Testing

Deep Insurance Industry Talent Pipeline On-Demand

Domain Expertise: Our team understands the nuances and intricacies of the insurance industry making it easier to identify challenges and provide tailored solutions

Domain Expertise: Our team understands the nuances and intricacies of the insurance industry making it easier to identify challenges and provide tailored solutions Cross-Functional Teams: Our team of 600+ actuaries, data analytics and IT professionals brings the diversity of skills necessary to solve our client's problems

Cross-Functional Teams: Our team of 600+ actuaries, data analytics and IT professionals brings the diversity of skills necessary to solve our client's problems Insurance-specific platforms for Policy Administration, Claims Management, Billing, Rating & Underwriting, CRMs (Salesforce/MS Dynamics with insurance add-ons)

Insurance-specific platforms for Policy Administration, Claims Management, Billing, Rating & Underwriting, CRMs (Salesforce/MS Dynamics with insurance add-ons) IT & Analytics platforms: Big Data platforms, Cloud Services, Databases, Analytics Tools, Machine Learning Frameworks, Integration & DevOps tools.

IT & Analytics platforms: Big Data platforms, Cloud Services, Databases, Analytics Tools, Machine Learning Frameworks, Integration & DevOps tools.

Enable Transformation To Drive Success

We're at the forefront of driving insurance companies into the future through our innovative Rating Modernization and Actuarial Transformation solutions. By harnessing the power of advanced data analytics, artificial intelligence, and machine learning, we revolutionize traditional premium calculation methods into dynamic, data-driven processes. Our tailored solutions empower insurance companies to accurately assess risks, optimize pricing strategies, and enhance customer experiences, paving the path to a more competitive, efficient, and customer-centric insurance landscape.

Our Value Proposition

Mitigate Risks with Fast Model Updates

With a faster TAT of rating model updates, we mitigate a wide variety of risks like active economic developments, constant regulatory changes, digital disruption, shifting workforce demographics, and employee lifecycle risks.

Delight Customers with Quick Responses

With our automated process we promise an improved TAT on both rating modernization & cost adjustments. Improved TAT on Customer-centric services leads to better customer satisfaction and retention.

Automated Processes for Enhanced Efficiency

Our AI-enabled operations suite coupled with the right shoring services reduces your operational costs by digitizing and automating processes. Reduce the resources needed to process claims with our innovative digital processes.

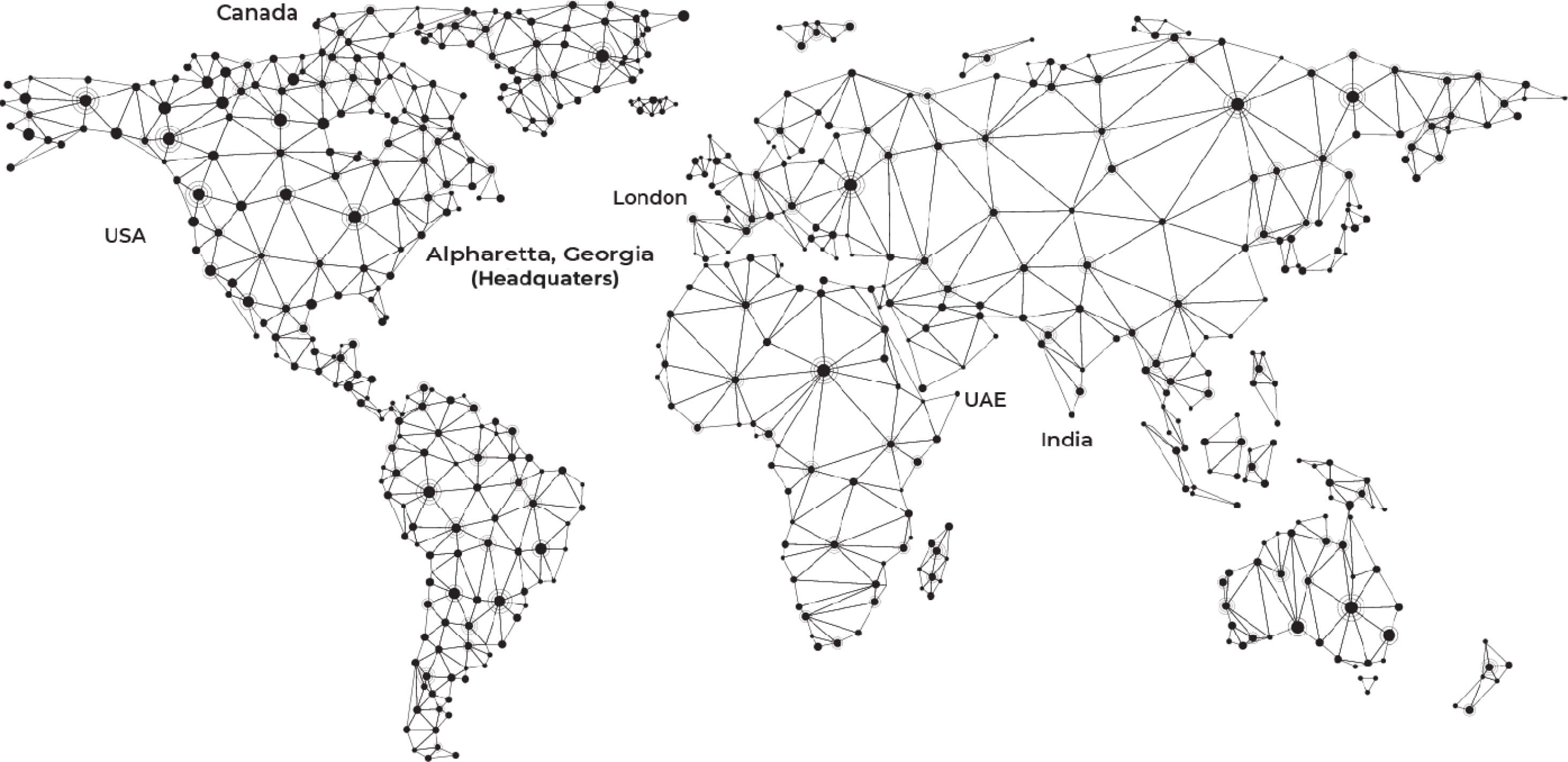

Our Footprints

Fortune 500

Multinational Clients

600+

Skilled Professionals

15

Global Locations

Headquartered in

Atlanta, Georgia